Prescription insurance is a business like any other. In order to survive, they must make a profit. How do casinos stay in business when they seem to give away so much money, both in the form of winnings and in “comps?” If they didn’t make money, there would be no Las Vegas. It’s the same with any industry. Insurance companies; whether auto insurance, home owner’s insurance, flood insurance, or prescription insurance, are in business to make money. They have devised their own creative ways to increase profits. Those profits are coming from their customers who use the insurance.

Prescription insurance is a business like any other. In order to survive, they must make a profit. How do casinos stay in business when they seem to give away so much money, both in the form of winnings and in “comps?” If they didn’t make money, there would be no Las Vegas. It’s the same with any industry. Insurance companies; whether auto insurance, home owner’s insurance, flood insurance, or prescription insurance, are in business to make money. They have devised their own creative ways to increase profits. Those profits are coming from their customers who use the insurance.

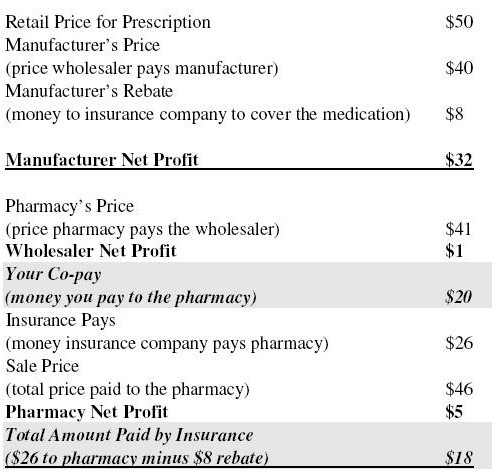

Don’t think that because the cash price for a drug is $50 and you have a $20 co-pay, the insurance is paying and therefore “losing” $30 every month. The reason for this goes back to the convoluted pricing system.

A very simple example of how this works follows:

You have a $20 co-pay for a medication that retails for $50. The manufacturer sells the drug to the wholesaler for $40. The manufacturer gives a rebate to the insurance (for various reasons) for $8, so the manufacturer nets $32. The wholesaler paid $40 and sells the drug to the pharmacy for $41, netting $1. The pharmacy gets a $20 co-pay from you plus $26 from your insurance for a total of $46, a $5 profit. Therefore, the insurance paid out $18 for your $20 co-pay. The $18 payment is the $26 it paid to the pharmacy minus the $8 rebate from the manufacturer.

In this example, you paid more than your insurance company did for the medication. When your insurance company raises your co-pay, you are paying a greater percentage of the retail cost of medication.

One of the reasons the manufacturer gives the insurance company a rebate has to do with prescription coverage of the drug. The insurance company makes a deal with the manufacturer to cover the medication for a rebate, which in our example was $8. The manufacturer had to pay the insurance company $8 for each prescription. If the manufacturer does not want to pay, then the insurance will not cover their medication. Therefore all the insurance company’s clients will get their medication from another manufacturer. They are making less profit per prescription, but more prescriptions are being purchased through insurance. It’s basically; give us money so you can make more money.

The insurance companies also influence the medication your doctor will prescribe for you. Have you ever tried to get your prescription filled only to have the pharmacist tell you it is not covered? Your doctor either did not check your insurance formulary or the one he has is out dated. The pharmacist will probably call the office for an alternate. Your insurance company is making health decisions based on their profits. They find the best deal, then cover that drug.